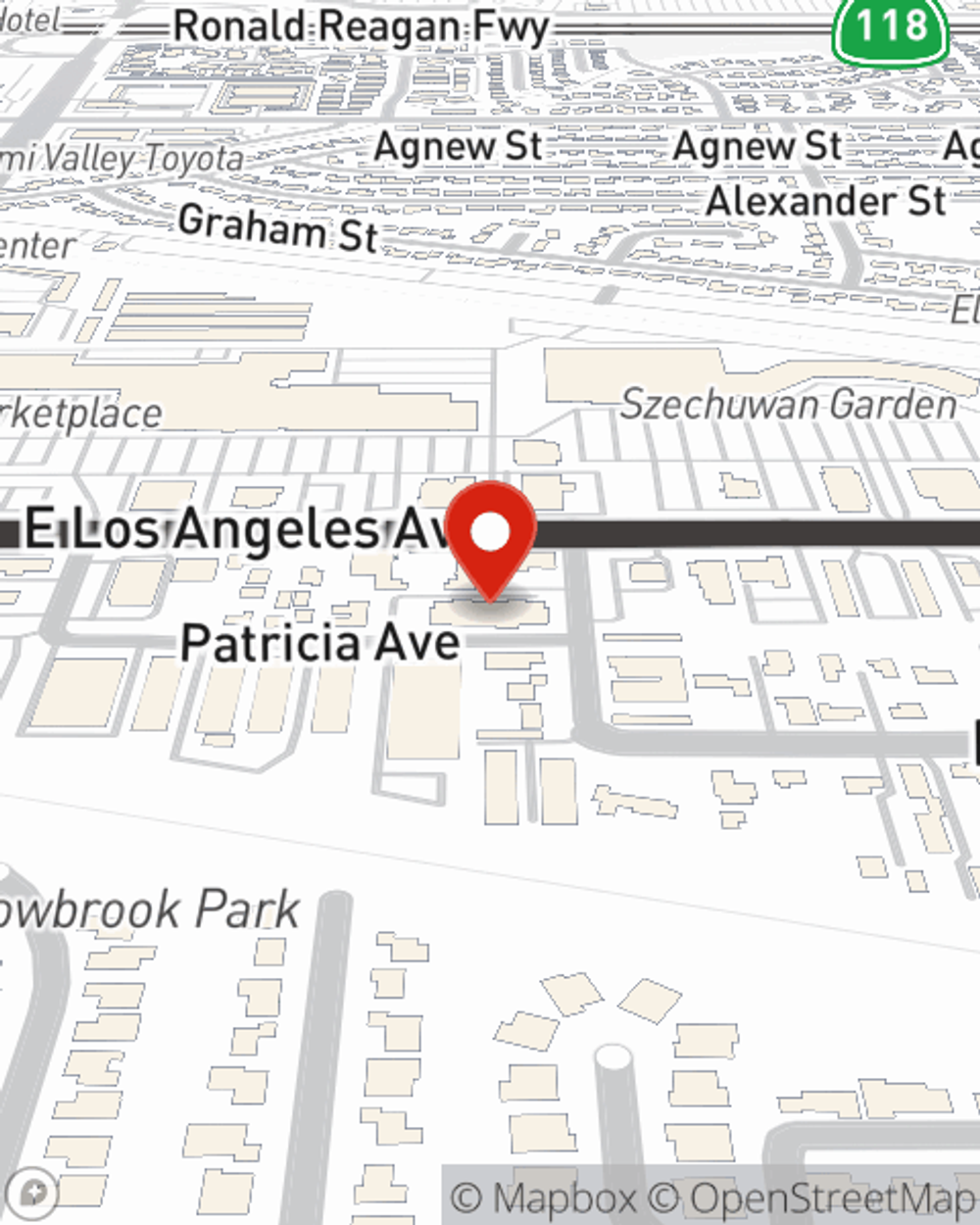

Homeowners Insurance in and around Simi Valley

Looking for homeowners insurance in Simi Valley?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

- Simi Valley

- Thousand Oaks

- Newbury Park

- Moorpark

- Westlake Village

- Agoura

- Agoura Hills

- Calabasas

- Santa Susana

- Camarillo

- Chatsworth

- Porter Ranch

- North Ranch

- Lang Ranch

- Lynn Ranch

- Wood Ranch

- Big Sky

What's More Important Than A Secure Home?

Your home and property have monetary value. Your home is more than just a roof over your head. It’s all the memories attached to every room. Doing what you can to keep your home protected just makes sense! A great next step is to get excellent homeowners insurance from State Farm.

Looking for homeowners insurance in Simi Valley?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Protect Your Home With Insurance From State Farm

Are you looking for a policy that can help protect both your home and your memorabilia? State Farm agent Darryl Nind's team is happy to help you set up a policy that's right for your needs.

Outstanding homeowners insurance is not hard to come by at State Farm. Before the unanticipated happens, reach out to agent Darryl Nind's office to help you find the ideal coverage options for your home.

Have More Questions About Homeowners Insurance?

Call Darryl at (805) 823-8373 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Can a power surge damage my electronics?

Can a power surge damage my electronics?

Help prevent power surges from zapping your electronics and protect your property from electrical hazards by following these tips.

How to be environmentally friendly at home and save on energy bills

How to be environmentally friendly at home and save on energy bills

Whether you’re looking to save some money or make changes for more environmentally friendly living, these tips may help.

Darryl Nind

State Farm® Insurance AgentSimple Insights®

Can a power surge damage my electronics?

Can a power surge damage my electronics?

Help prevent power surges from zapping your electronics and protect your property from electrical hazards by following these tips.

How to be environmentally friendly at home and save on energy bills

How to be environmentally friendly at home and save on energy bills

Whether you’re looking to save some money or make changes for more environmentally friendly living, these tips may help.